This past summer, the Governor of the State of Maine signed a budget that included the creation of a paid family and medical leave (PFML) program. While the program begins in 2026, our Acadia Benefits team has started working with customers to prepare for this upcoming requirement.

This past summer, the Governor of the State of Maine signed a budget that included the creation of a paid family and medical leave (PFML) program. While the program begins in 2026, our Acadia Benefits team has started working with customers to prepare for this upcoming requirement.

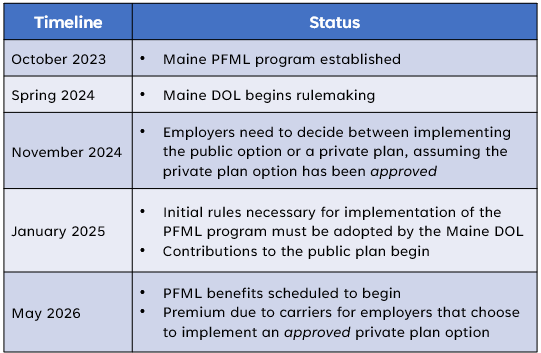

On the right, there is a timeline for your reference and you can find additional details on the Maine Department of Labor’s website, linked here. Please note that the information shared in this blog post is based on the statute, and the rulemaking providing clarification and details for these statutory benefits is set to begin this spring.

The November 2024 date is important for employers to pay attention to and while November may seem a long way off, businesses need to start thinking about whether the public option or private plan will be best for their organization. These two program options will be available for employers to choose from with the expectation that some carriers will offer a private plan, and the employer has had their plan approved.

Here is what we know about the 2 options that employers will decide between.

- Option 1 is the state-run PFML: If employers intend to participate in the state-run PFML they are required to start remitting premiums to the state’s PFML fund starting January 1, 2025.

- For employers with 15 or more employees, the law allows up to 50% of the premium to be deducted from employee wages.

- Small businesses with fewer than 15 employees are exempted from the employer contribution but would still have to deduct and submit 50% of the premium from employee wages.

- The premium is capped at 1.0% of wages for each Maine employee. The wage cap for premium contributions is the Social Security wage base.

- Option 2 is the private PFML: If employers would like to participate in a private plan, the plan has to be approved. An employer with an approved private plan under section 850-H is not required to remit premiums under this section to the fund. Other considerations include:

- The cost to employees covered by the private plan is not greater than what they would be required to pay to the state plan.

- The plan meets or exceeds the state plan provisions.

- Provides coverage for all employees throughout employment.

Additional details that are important for employers to consider:

- The taking of PFML may not affect an employee’s right to accrue vacation time, sick time, bonuses, advancement, seniority, length of service credit, or other employment benefits, plans, or programs.

- Employers will want to evaluate existing STD and leave policies to make sure they’re aligned and integrated with new paid leave requirements.

- During the duration of an employee’s PFML, the employer shall continue to provide for and contribute to the employee’s employment-related health insurance benefits, if any, at the level and under the conditions coverage would have been provided if the employee had continued working continuously for the duration of the leave.

- Absent an emergency, illness, or necessity to take leave, an employee must give “reasonable notice” to the employer of their intent to take leave.

- Proof must be provided that the individual qualifies under one of the approved reasons for leave.

- The scheduling of an employee taking leave must not cause “undue hardship” on the employer.

- Individuals who have not worked for an employer for at least 120 days are not guaranteed job protections when taking leave.

The #1 question we have been getting from customers is what should we do now? We have been telling businesses to start thinking about how this PFML will impact other employee benefits and whether a state-run or private option may be the best fit. Of course, it is hard to make any decisions without all the details, but businesses should plan for this requirement and start considering the type of program that will be the right option for your company, and employees. We also have additional ME PFML resources on our blog that may provide helpful details about the program.

- Webinar Recording and Presentation Hosted by Acadia Benefits and Eaton Peabody: What Employers Need to Know About the Maine Paid Family and Medical Leave Program (September 2023)

- Maine Paid Family and Medical Leave: What You Need to Know (August 2023)

Our Acadia Benefits team is happy to get on a call to discuss what we’ve deployed in other states and additional details that local businesses should be aware of. We will continue to provide information as it becomes available and communicate what you need to know as we learn more. If you have any questions, our team is always available to help!

Kevin Kennedy

207.615.0560

KKennedy@AcadiaBenefits.com

This information is general and is provided for educational purposes only. It reflects our understanding of the available guidance as of the date shown and is subject to change. It is not intended to provide legal advice. You should not act on this information without consulting knowledgeable advisors.