The IRS recently issued Revenue Procedure 2022-24 to announce the 2023 inflation-adjusted amounts that apply to health savings accounts (HSAs) and high-deductible health plans (HDHPs). The newly announced figures include the maximum contribution limit for an HSA, the minimum permissible deductible for an HDHP, and the maximum limit on out-of-pocket expenses (e.g., deductibles, copayments, and other amounts aside from premiums) for qualifying HDHPs. These limits will differ depending on whether an individual is covered by a self-only or family coverage tier under an HDHP.

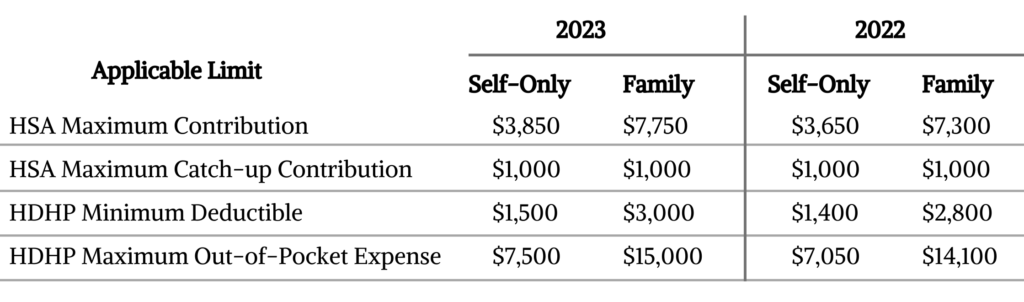

The IRS’s new higher HSA contribution limit and HDHP out-of-pocket maximum will take effect on January 1, 2023. HDHP deductible limits will increase for plan years that begin on or after January 1, 2023. The chart below shows the old 2022 limits as well as the new 2023 limits. Also, note that the maximum permitted catch-up HSA contribution for eligible individuals who are 55 or older remains unchanged for 2023.

Employers that sponsor HDHPs may need to make plan design changes as they finish 2023 planning. Additionally, affected employers will need to ensure that they update all plan communications, open enrollment materials, and other documentation that addresses these limits to be sure participants and beneficiaries are adequately informed.

The IRS also announced that the maximum amount that can be made newly available in 2023 for an Excepted Benefit HRA (EBHRA) is $1,950.

If you have any questions, please feel free to contact your Account Manager for further assistance and we are happy to help.